Can You Receive Paid Family Benefits That Are Not Reported on 1099-hg

Which States Are Givers and Which Are Takers?

And is that even the right way to frame the question?

Updated on March 8, 2017.

Maps showing regional differences among Americans are all the rage these days, such as this depiction of the contours of baseball game fandom, or this 1 of the beers nosotros're alleged to favor, or this showing the places in America where none of u.s. lives, or this creative video/map showing where Americans utilize different words for common things such equally soda.

For my coin, one of the more interesting maps appearing recently came from the personal-finance website WalletHub. Analysts there ready out to determine how states compare in terms of their reliance on federal funding.

The WalletHub analysts essentially asked how much each state receives dorsum as a return on its federal income-tax investment. They compared the fifty states and the District of Columbia on three metrics: (one) federal spending per capita compared with every dollar paid in federal income taxes; (two) the percentage of a country'south annual revenue that comes from federal funding; and (3) the number of federal employees per capita. The third measure received merely half the weight of each of the others in the adding.

What the resulting map shows is that the nigh "dependent states," every bit measured by the composite score, are Mississippi and New United mexican states, each of which gets back most $3 in federal spending for every dollar they transport to the federal treasury in taxes. Alabama and Louisiana are close behind.

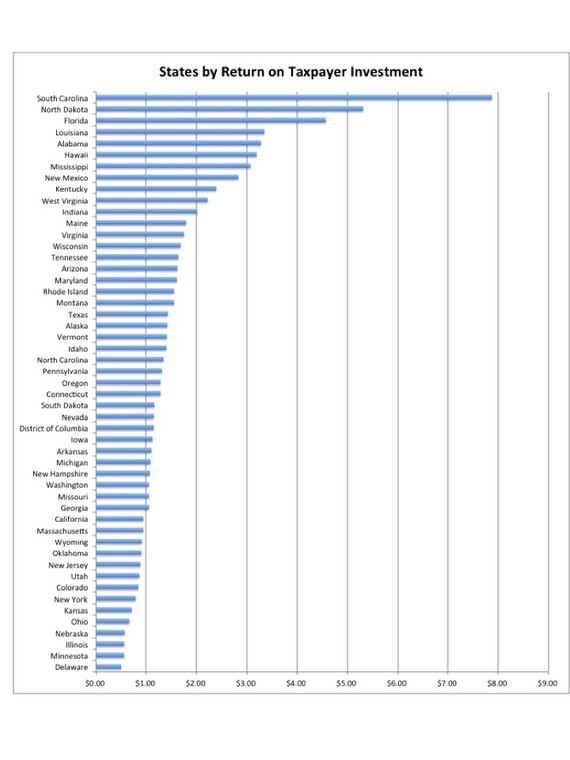

If you expect only at the first measure—how much the federal regime spends per person in each state compared with the corporeality its citizens pay in federal income taxes—other states stand out, particularly South Carolina: The Palmetto Land receives $7.87 back from Washington for every $1 its citizens pay in federal tax. This bar chart, fabricated from WalletHub's information, reveals the sharp discrepancies among states on that measure.

On the other side of this grouping, folks in fourteen states, including Delaware, Minnesota, Illinois, Nebraska, and Ohio, go back less than $1 for each $1 they spend in taxes.

It's not simply that some states are getting mode more in return for their federal tax dollars, but the disproportionate amount of federal aid that some states receive allows them to keep their own taxes artificially low. That'due south the argument WalletHub analysts brand in their 2014 report on all-time and worst states to be a taxpayer.

Function of the explanation for why southern states dominate the "most dependent" category is historical. During the many decades in the 20th century when the South was solidly Democratic, its congressional representatives in both the House and the Senate, enjoying keen seniority, came to concur leadership positions on powerful committees, which they used to send federal dollars back to their home states in the class of contracts, projects, and installations.

Another office of the explanation is easier to discern. The reddest states on that map at the top—Mississippi, Alabama, Louisiana, New Mexico, Maine—have exceptionally high poverty rates and thus receive disproportionately large shares of federal dollars. Through a variety of social programs, the federal authorities disburses hundreds of billions of dollars each year to maintain a "prophylactic internet" intended to aid the neediest among us. Consider, for example, the percentage of each country'due south residents who go nutrient stamps through the federal regime'southward SNAP programme. This chart tells the story.

Some other manner of getting at the same point is to map the percent of families in 2012 with incomes below the federal poverty level (according to the Census Agency's ACS five-yr estimate). This map, fabricated through Social Explorer, shows the information at the county level: The darker the shading, the higher the percentage of impoverished residents.

You can go here to run across an interactive version of this map that enables you to curlicue your cursor over counties and get pop-up information showing the percentages for any specific canton. You can also alter the map view, showing the data at different levels, ranging from states all the fashion down to individual census block groups. (To see the mapped information at sub-canton levels, you have to zoom way in to particular areas.)

At that place are various ways of thinking about what WalletHub's "state dependency" map tells u.s.a.. One approach is to shine calorie-free on the red-states-as-takers paradox: Dominated by Republican voters who profess their distaste for the federal government and its social programs, these are the very states that rank highest on the dependency alphabetize. That, for example, is how Business Insider handled the story:

Who actually benefits from government spending? If you listen to Rush Limbaugh, you might think it was those blue states, packed with damn hippie socialist liberals, sipping their lattes and providing free abortions for bored, horny teenagers. ...

As it turns out, information technology is red states that are overwhelmingly the Welfare Queen States. Yes, that'due south right. Red States—the ones governed by folks who think regime is too big and spending needs to be cut—are a net drain on the economy, taking in more federal spending than they pay out in federal taxes. They talk a skilful game, merely stick Blue States with the bill.

Off-white plenty. That's a catchy perspective. And there are few things more fun than exposing hypocrisy.

Alternatively, we could utilize the "land dependency" map as an opportunity to reflect on a dissimilar paradox—the long-standing role of the far-away federal government every bit an amanuensis of community. Considering of federal programs, people in places like South Carolina and Mississippi are getting a helping manus not from their neighbors a few blocks away or in the next canton over, only from residents of Delaware, Minnesota, Illinois, and Nebraska. Whether you lot like that idea depends, in office, on how yous personally reconcile the tension between ii long-cherished, core American values—our passion for individualism and our regard for customs—and whether you meet "community" as encompassing the whole country.

That'due south a far more interesting thing to call back well-nigh (though perhaps less viscerally satisfying) than which states are moochers or freeloaders and which are getting fleeced.

Source: https://www.theatlantic.com/business/archive/2014/05/which-states-are-givers-and-which-are-takers/361668/

0 Response to "Can You Receive Paid Family Benefits That Are Not Reported on 1099-hg"

Post a Comment